Business

UK interest rate forecast suggests potential decrease

The Bank of England’s established interest rate has a significant impact on the rates applied to mortgages, loans, and savings for a large number of people.

At its first meeting of 2026, the Bank of England maintained the interest rate at 3.75%, a level that has been in place since February 2023, following a reduction from 4% in December.

The decision has sparked debate among analysts, who are uncertain about the frequency and timing of potential future rate cuts, with some predicting a gradual decline and others anticipating a more cautious approach.

The interest rate has a significant impact on the financial lives of millions of people, influencing the cost of borrowing and the returns on savings for mortgage holders, credit card users, and savers.

In essence, an interest rate determines the cost of borrowing money or the reward for saving, with the Bank of England's base rate serving as a benchmark for other banks and building societies.

The base rate, which is the interest rate at which the Bank of England lends to other financial institutions, has a ripple effect on the rates offered to consumers for mortgages and savings accounts.

The Bank of England's primary objective is to maintain UK inflation at or near 2% by adjusting its benchmark interest rate, which involves a delicate balance between stimulating economic growth and controlling price increases.

When inflation exceeds the target, the Bank typically responds by increasing interest rates to curb spending, reduce demand, and mitigate price growth.

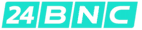

The Consumer Prices Index (CPI), the main measure of inflation, has decreased substantially since reaching a peak of 11.1% in October 2022, but it remains a key area of focus for the Bank.

According to the latest data, CPI inflation stood at 3.4% in the year to December 2025, up from 3.2% in November and slightly above expectations, prompting the Bank to maintain a watchful eye on the economy.

The Office for National Statistics (ONS) attributed the increase in inflation to higher prices for tobacco products and air travel during the holiday season.

The Bank of England's base rate had previously reached a high of 5.25% in 2023, remaining at that level until August 2024, when a series of cuts began to bring rates down.

Following five consecutive cuts, the rate was reduced to 4% before being held steady at the Bank's meetings in September and November 2025, and then cut again in December, with the January rate remaining unchanged.

While most analysts had anticipated the December rate cut, the decision was not unanimous, with only five members of the nine-member Monetary Policy Committee (MPC) voting in favor.

The January decision was also closely contested, with a 5-4 vote reflecting the ongoing debate among policymakers.

In a statement, Bank of England Governor Andrew Bailey expressed optimism that inflation would decline to around 2% by the spring, paving the way for potential future rate cuts.

Bailey cautioned, however, that the Bank must ensure that inflation remains under control, leaving room for further rate adjustments if necessary.

The prospect of further rate cuts is closely tied to the inflation outlook, with the Bank poised to respond if price growth fails to slow or begins to rise again.

Analysts generally expect one or two rate cuts in 2026, with many predicting the first cut to occur in April and a potential second cut towards the end of the year.

The next interest rate decision is scheduled for Thursday, March 19.

Mortgage rates have a significant impact on household finances, with nearly a third of households holding a mortgage, according to the English Housing Survey.

Approximately 500,000 homeowners have mortgages that track the Bank of England's base rate, making them eligible for lower monthly repayments if rates fall.

An additional 500,000 homeowners on standard variable rates rely on their lenders to pass on any rate cuts, while the majority of mortgage customers have fixed-rate deals that are less directly affected by rate changes.

As of February 5, the average two-year fixed residential mortgage rate was 4.85%, according to Moneyfacts, with a five-year rate averaging 4.95%.

The average two-year tracker rate was 4.41%, highlighting the variation in mortgage rates available to consumers.

With many fixed-rate mortgages set to expire in the coming years, borrowers can expect to face higher interest rates when they remortgage, with around 800,000 fixed-rate mortgages with rates of 3% or below due to expire annually until the end of 2027.

To understand how changes in interest rates may affect their mortgage, borrowers can use a mortgage calculator to model different scenarios.

The calculator can help homeowners anticipate how changes in interest rates may impact their monthly payments and overall borrowing costs.

In addition to mortgages, Bank of England interest rates influence the cost of credit card debt, bank loans, and car loans, with lenders often adjusting their rates in response to changes in the base rate.

While lenders may reduce their interest rates in response to Bank of England cuts, this process can be slow, leaving borrowers to wait for the benefits of lower rates to materialize.

The impact of interest rates is not limited to borrowing, as the base rate also affects the returns on savings accounts, with a falling base rate likely to result in lower interest rates for savers.

As of February 5, the average rate for an easy access savings account was 2.42%, according to Moneyfacts, highlighting the relatively low returns available to savers.

Further cuts in interest rates could have a significant impact on those who rely on the interest from their savings to supplement their income, making it essential for savers to monitor rate changes and adjust their financial plans accordingly.

In recent years, the UK has had one of the highest interest rates among the G7 nations, with the European Central Bank (ECB) also adjusting its main interest rate for the eurozone in response to changing economic conditions.

In June 2024, the ECB began cutting its main interest rate from an all-time high of 4%, marking a shift in the monetary policy landscape.

The ECB's decision to cut rates reflects the ongoing efforts of central banks to balance economic growth and inflation, with the UK and other countries closely watching the impact of these decisions on their own economies.

As the global economy continues to evolve, the interplay between interest rates, inflation, and economic growth will remain a critical area of focus for policymakers, analysts, and consumers alike.

With the next interest rate decision approaching, all eyes will be on the Bank of England as it navigates the complex landscape of monetary policy and works to maintain economic stability.

The impact of interest rates on personal finances cannot be overstated, with changes in the base rate having far-reaching consequences for mortgage holders, savers, and borrowers.

As the UK and other countries navigate the challenges of inflation and economic growth, the role of interest rates in shaping the financial landscape will continue to be a subject of intense scrutiny and debate.

The European Central Bank's decision to cut its main interest rate in June 2024 marked a significant turning point in the eurozone's monetary policy, with the UK and other countries closely monitoring the effects of this decision on their own economies.

In June 2025, the European Central Bank implemented a 0.25 percentage point reduction in interest rates, bringing them down to 2%, a level that has been maintained since then.

The Federal Reserve, the central bank of the United States, has lowered interest rates on three occasions since September 2025, resulting in a current range of 3.5% to 3.75%, the lowest level seen since 2022. The Fed opted to keep rates unchanged at its meeting in January 2026.

Prior to the recent rate cuts, President Trump had been critical of the Federal Reserve for not taking action sooner. Meanwhile, Trump has selected Kevin Warsh as his choice to succeed Jerome Powell as chairman of the Fed when Powell's four-year term expires in May.

Business

Artist Alleges AirAsia Used His Work Without Permission

A street artist from Penang has reported that one of his artworks has been replicated and featured on the design of an airplane.

A lawsuit has been filed by a Malaysian-based artist against AirAsia and its parent company, Capital A Berhad, alleging unauthorized use of the artist's designs on one of the airline's planes.

According to the lawsuit, Ernest Zacharevic, a Lithuanian-born artist residing in Penang, claims that his 2012 street mural, Kids on Bicycle, was reproduced and displayed on an AirAsia aircraft in late 2024 without his permission.

Zacharevic states that the use of his design was unauthorized, and no licensing agreement or consent was obtained, adding that the livery was removed after he publicly expressed concerns about the matter.

The BBC has reached out to AirAsia for a statement regarding the allegations.

In an interview with the BBC on Thursday, Zacharevic recalled that he first became aware of the alleged copyright infringement in October 2024, when he discovered that an AirAsia plane was featuring a livery resembling his artwork.

With over a decade of experience in Malaysia, Zacharevic is known for his roadside murals in Penang, which have become a staple of the local art scene.

One of Zacharevic's notable works is the 2012 street mural Kids on Bicycle, created for a local festival, which features two children on a bicycle integrated into the mural, located in George Town's heritage district.

The mural has become a popular tourist attraction, with many visitors taking photos in front of the iconic artwork.

Zacharevic alleges that his work was reproduced on an AirAsia plane without his knowledge or consent, and he personally witnessed the plane in operation at an airport.

Recalling the incident, Zacharevic expressed his discomfort with the situation, which occurred in 2024.

He took to social media to address the issue, posting a photo of the plane and tagging the airline, suggesting that they needed to discuss the use of his artwork.

Since then, Zacharevic has engaged in discussions with the company, but they have been unable to come to a mutually agreeable resolution.

This is not the first instance of Zacharevic's work being used in connection with AirAsia, as he claims the airline has also used his artwork on a delivery bag for its food services arm.

Court documents reveal that Zacharevic had previously discussed a potential collaboration with AirAsia in 2017, where he would create art for the airline's jets and a mural in one of their offices.

According to the documents, Zacharevic had informed the airline of his work and business rates during these discussions.

The lawsuit asserts that despite being aware of Zacharevic's work and rates, the airline proceeded to reproduce and publicly display one of his notable works, thereby infringing on his copyright and moral rights.

As the largest low-cost carrier in Asia, AirAsia operates over 200 jets to more than 100 destinations, and has recently announced plans to resume flights from Kuala Lumpur to London via Bahrain.

Zacharevic has stated that he will leave it to the court to determine any potential compensation he may be entitled to.

The artist emphasized that he does not consider the use of his artwork to be a mere reference to cultural or geographical associations, but rather a distinct artistic creation.

Zacharevic stressed that his artwork is the result of years of professional training, skill, and labor, and should be recognized as such.

Business

US Businesses and Consumers Bear Brunt of Trump Tariff Costs, According to NY Fed

In 2022, the United States saw a significant increase in collective import tariff rates, with rates rising by more than 300 percent for a range of imported goods.

The modification of tariff agreements by President Donald Trump with several countries had a consistent outcome: increased costs for US-based companies and consumers.

According to a study released on Thursday by the Federal Reserve Bank of New York, the average tariff rate on imported goods increased significantly, rising from 2.6% at the beginning of the year to 13% in 2025.

The New York Fed's research revealed that US companies absorbed approximately 90% of the costs associated with the higher tariffs imposed by Trump on goods from countries such as Mexico, China, Canada, and the European Union.

The Federal Reserve Bank of New York stated that "the majority of the economic burden of the high tariffs imposed in 2025 continues to be borne by US firms and consumers."

When tariff rates changed and increased in the previous year, exporting countries did not adjust their prices to mitigate potential declines in US demand.

Instead of lowering prices, exporters maintained their existing prices and transferred the tariff costs to US importers, who subsequently increased the prices of these goods for consumers.

The response of exporters in 2025 was similar to their reaction in 2018, when Trump introduced certain tariffs during his first term, resulting in higher consumer prices with minimal other economic effects, as noted by the New York Fed at the time.

The New York Fed's findings on Thursday are consistent with the results of other recent analyses.

The Kiel Institute for the World Economy, a German research organization, reported last month that its research indicated "nearly complete pass-through of tariffs to US import prices."

By analyzing 25 million transactions, Kiel researchers discovered that the prices of goods from countries like Brazil and India did not decrease.

The Kiel report noted that "trade volumes declined" instead, indicating that exporters preferred to reduce the quantity of goods shipped to the US rather than lower their prices.

The National Bureau of Economic Research also found that the pass-through of tariffs to US import prices was "nearly 100%", meaning that the US bears the cost of the price increase, not the exporting countries.

Similarly, the Tax Foundation, a Washington DC-based think tank, found that the increased tariffs on goods in 2025 resulted in higher costs for American households.

The Tax Foundation considered tariffs as a new tax on consumers and estimated that the 2025 increases resulted in an average cost of $1,000 (£734.30) per household, with a projected cost of $1,300 in 2026.

The Tax Foundation reported that the "effective" tariff rate, which accounts for decreased consumer purchases due to higher prices, is now 9.9%, representing the highest average rate since 1946.

The Tax Foundation concluded that the economic benefits of tax cuts included in Trump's "Big Beautiful Bill" will be entirely offset by the impacts of the tariffs on households.

Business

BBC Reporter Exposed to Cyber Attack Due to Vulnerabilities in AI Coding Tool

The demand for vibe-coding tools, which enable individuals without coding experience to develop applications using artificial intelligence, is experiencing rapid growth.

A significant and unresolved cyber-security vulnerability has been identified in a popular AI coding platform, according to information provided to the BBC.

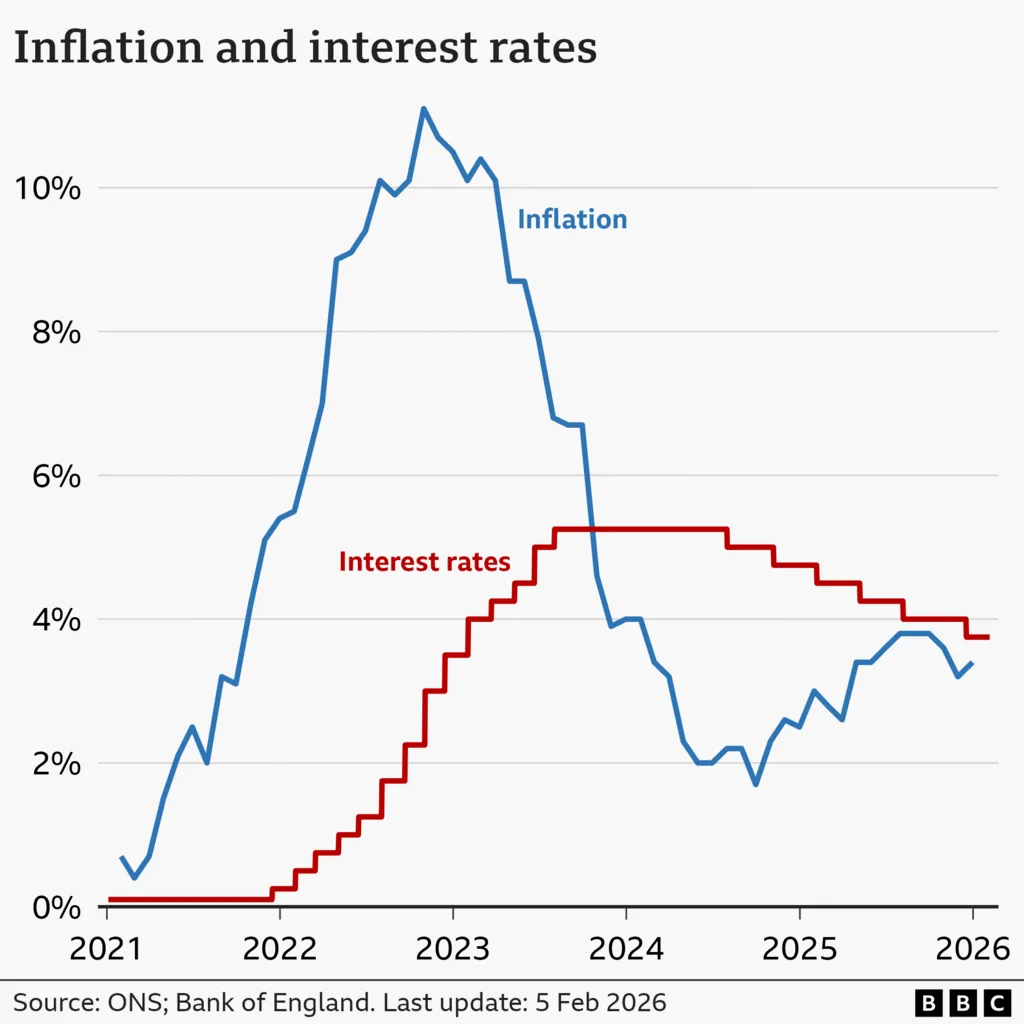

The platform, known as Orchids, utilizes a "vibe-coding" approach, enabling individuals without technical expertise to create apps and games by inputting text prompts into a chatbot.

In recent months, such platforms have gained widespread popularity, often being touted as an early example of how AI can rapidly and affordably perform various professional tasks.

However, experts warn that the ease with which Orchids can be compromised highlights the risks associated with granting AI bots extensive access to computers in exchange for autonomous task execution.

Despite repeated requests for comment, the company has not responded to the BBC's inquiries.

Orchids claims to have a user base of one million and boasts partnerships with top companies, including Google, Uber, and Amazon.

According to ratings from App Bench and other analysts, Orchids is considered the top program for certain aspects of vibe coding.

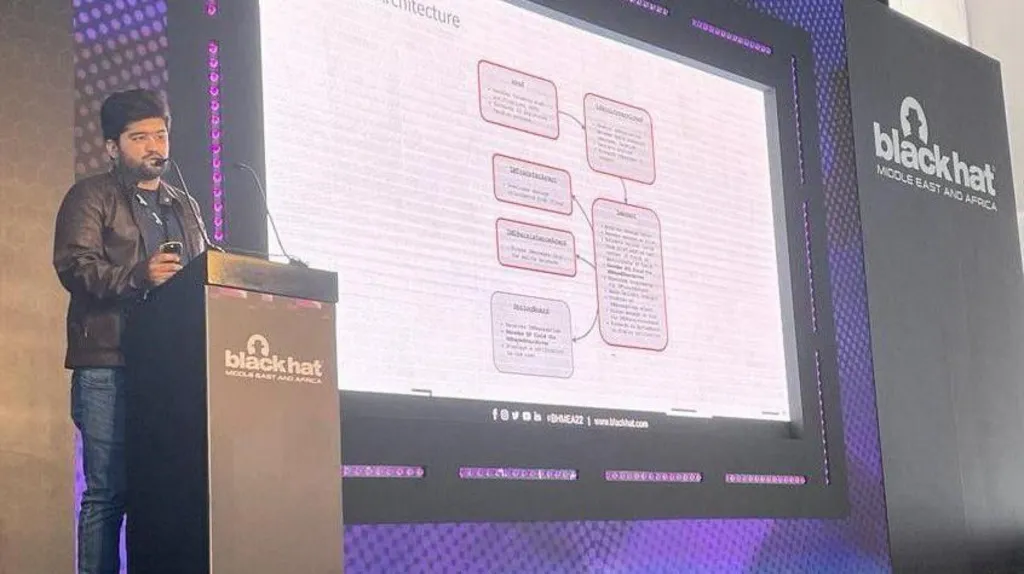

Cyber-security researcher Etizaz Mohsin demonstrated the platform's security flaws to the BBC.

To test the platform's security, a spare laptop was used to download the Orchids desktop app and initiate a vibe-coding project.

A request was made to the Orchids AI assistant to generate code for a computer game based on the BBC News website.

The AI assistant automatically compiled code on the screen, which, without prior experience, was unintelligible.

By exploiting a specific cyber-security weakness, Mohsin was able to access the project and view and edit the code.

Mohsin then added a line of code to the project, which went unnoticed.

This action apparently allowed him to gain access to the computer, as evidenced by the subsequent appearance of a "Joe is hacked" notepad file on the desktop and a changed wallpaper featuring an AI hacker image.

The potential implications of this hack on the platform's numerous projects are significant.

A malicious hacker could have easily installed a virus on the machine without any action required from the victim.

Sensitive personal or financial data could have been compromised.

An attacker could have accessed internet history or even used the computer's cameras and microphones for surveillance.

Most cyber-attacks involve tricking victims into downloading malicious software or divulging login credentials.

This particular attack was carried out without any involvement from the victim, known as a zero-click attack.

Mohsin stated that the vibe-coding revolution has introduced a new class of security vulnerabilities that did not previously exist, highlighting the risks associated with relying on AI to handle tasks.

The concept of AI handling tasks autonomously comes with significant risks, according to Mohsin.

Mohsin, a 32-year-old from Pakistan currently residing in the UK, has a history of discovering dangerous software flaws, including work on the Pegasus spyware.

Mohsin discovered the flaw in December 2025 while experimenting with vibe-coding and has since attempted to contact Orchids through various channels, sending around a dozen messages.

The Orchids team responded to Mohsin this week, stating that they may have missed his warnings due to being overwhelmed with incoming messages.

According to the company's LinkedIn page, Orchids is a San Francisco-based company founded in 2025 with fewer than 10 employees.

Mohsin has only identified flaws in Orchids and not in other vibe-coding platforms, such as Claude Code, Cursor, Windsurf, and Lovable.

Nonetheless, experts caution that this discovery should serve as a warning.

Professor Kevin Curran of Ulster University's cybersecurity department notes that the main security implications of vibe-coding are the potential for code to fail under attack due to a lack of discipline, documentation, and review.

Agentic AI tools, which perform complex tasks with minimal human input, are increasingly gaining attention.

A recent example is the Clawbot agent, also known as Moltbot or Open Claw, which can execute tasks on a user's device with little human intervention.

The free AI agent has been downloaded by hundreds of thousands of people, granting it deep access to computers and potentially introducing numerous security risks.

Karolis Arbaciauskas, head of product at NordPass, advises caution when using such tools.

Arbaciauskas warns that while it may be intriguing to see what an AI agent can do without security measures, this level of access is also highly insecure.

He recommends running these tools on separate, dedicated machines and using disposable accounts for experimentation.

To stay informed about the latest tech stories and trends, sign up for the Tech Decoded newsletter, available outside the UK as well.

(Removed to maintain the same number of paragraphs)

-

News10 hours ago

News10 hours agoAustralian Politics Faces Questions Over Gender Equality Amid Sussan Ley’s Appointment

-

News7 hours ago

News7 hours agoFarage Says Reform to Replace Traditional Tory Party

-

News7 hours ago

News7 hours agoWrexham Pair Seek Win Against Former Team Ipswich

-

News12 hours ago

News12 hours agoLiberal Party Removes Australia’s First Female Leader

-

News10 hours ago

News10 hours agoUK Braces for Cold Snap with Snow and Ice Alerts Expected

-

News7 hours ago

News7 hours agoHusband’s alleged £600k theft for sex and antiques blamed on drug side effects

-

News2 days ago

News2 days agoSunbed ads spreading harmful misinformation to young people

-

Business12 hours ago

Business12 hours agoBBC Reporter Exposed to Cyber Attack Due to Vulnerabilities in AI Coding Tool